It is always good to take a look at long-term trends when short-term volatility increases, in order to have a better sense of the market direction. While the widely anticipated stock market correction remains a possibility, in our view, the long-term bullish trend for U.S. equities is still intact.

The chart shows that the multi-year uptrend for the benchmark Fidelity Spartan U.S. Equity Index Fund (FUSEX) has not yet been interrupted by the recent market volatility:

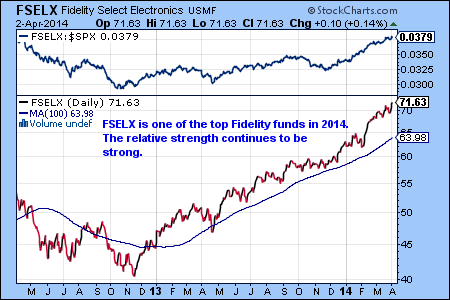

In a recent article (see Best Fidelity Mutual Funds for 2015) we highlighted the most attractive investments for 2015. The selected mutual funds have continued to perform well in the last few weeks of trading. Especially, conservative sectors, such as real estate, utilities, medical equipment and consumer staples have outperformed the S&P 500 index:

Perhaps, the most interesting new development in 2015 is the renewed interest in buying gold mining stocks. The chart of the Fidelity Select Gold Fund (FSAGX) below shows a short-term bullish double bottom pattern and increased buying activity during the first two weeks of the New Year. However, gold has a long way to go before it can establish a long-term uptrend.

While gold is traditionally viewed as an inflation hedge, in the current deflationary environment precious metals are looked at as an alternate asset class that can potentially serve as a volatility hedge. We’d like to caution investors, that while gold can provide returns that have low correlation with equities, this sector is highly speculative and is more appropriate for the purposes of short-term trading than long-term investing.

As noted in earlier articles, we believe that it is still too early to diversify into the weakest sectors, such as natural resources (in particular energy), and into underperforming international markets.

The blue lines on the charts of the Fidelity Select Energy Fund (FSENX) and the Fidelity Latin America Fund (FLATX) indicate that the bearish downtrends that are still in place:

Read more about investment strategies involving these funds at FidelitySignal.com

.