Summary

- A technical screen of Fidelity mutual funds shows that new investment areas emerged in 2015 to lead the market

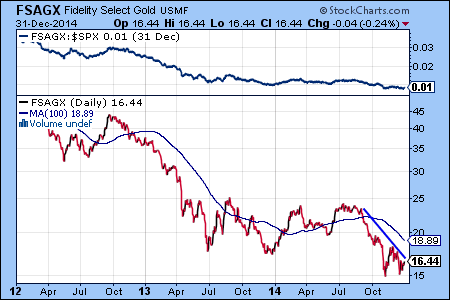

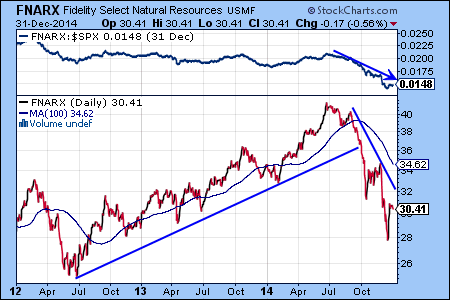

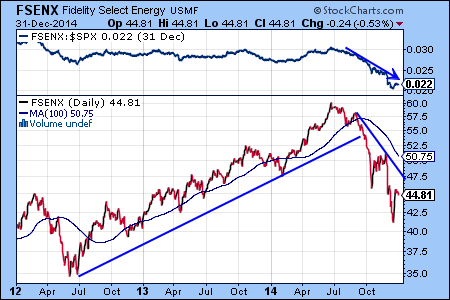

- The natural resources sector, which includes energy, has the potential to provide market-beating returns. On the other hand, investors shouldn’t expect low volatility, because commodity prices can fluctuate in a wide range

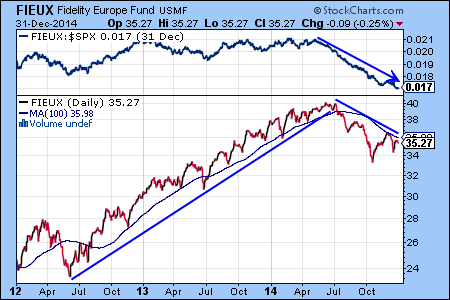

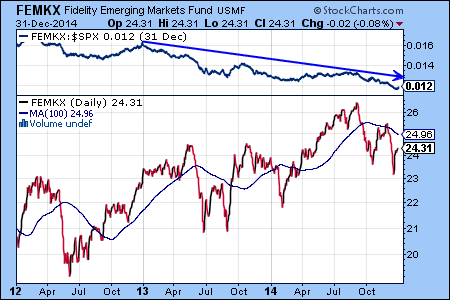

- International markets, most notably Asia and Europe, may outperform U.S. equities this year

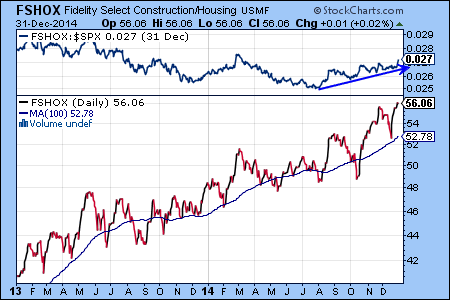

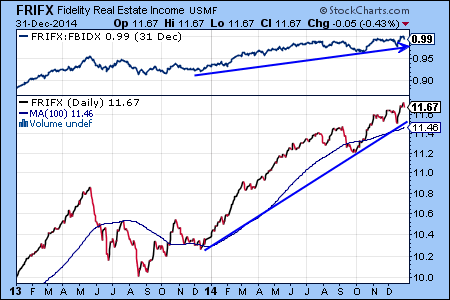

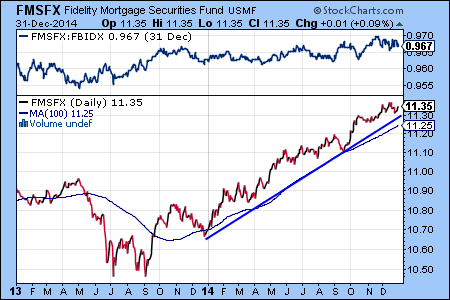

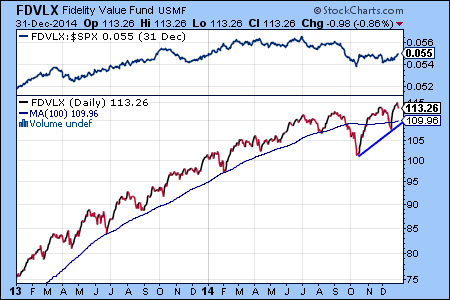

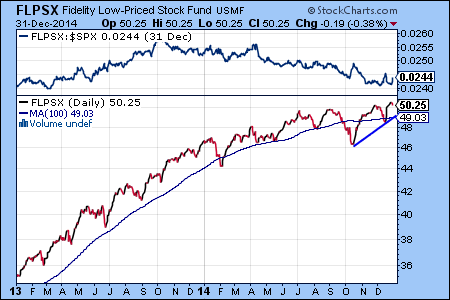

From time-to-time, it is important to take a broad view of the market, so we can better understand the changing conditions and dynamics. Five month ago, back in November 2014, our momentum screen showed that the top 10 Fidelity mutual funds were all equity funds representing the consumer, health care and transportation sectors of the U.S. economy (see article).

While equity funds continue to outperform bond funds, the picture is very different now. Mutual funds investing in energy and other natural resources, and international markets are the market leaders. At the same time, select U.S. sectors, such as utilities, are lagging:

Speculation about bottoming oil and commodity prices have caused an impressive rally in the natural resources sector. A great way to participate in the potentially long-term bullish trend in this sector is via the Fidelity Select Natural Resources Fund (FNARX).

The Fidelity China Region fund (FHKCX) is now the best year-to-date performer of all Fidelity mutual funds with a 20.97% gain.

Visit FidelitySignal.com for additional investment strategies.

.