Summary:

- Economic conditions continue to favor real estate investments

- Municipal income and mortgage securities can provide an alternate source of income for bond investors

- Style rotation: value investing is likely to outperform growth stocks in 2015, just as small caps have the potential to outperform large caps

- Gold has not yet emerged as a good choice for diversification

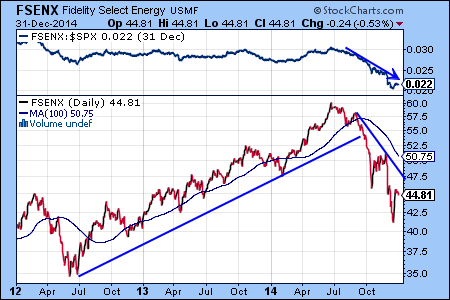

- It is too early to invest in the energy sector or in international equities

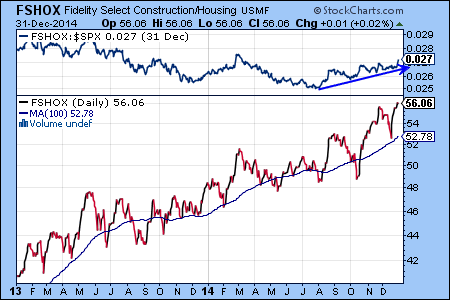

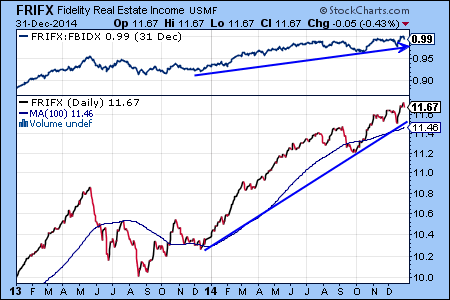

The slowly improving U.S. economy and low interest rates have created a favorable environment for real estate investments. The Select Construction and Housing Fund (FSHOX) and the Real Estate Income Fund (FRIFX) are two excellent Fidelity funds, which allow investors to participate in this trend. The blue arrow in the top panel of the chart below shows that FSHOX has a positive relative strength compared to the S&P 500 index, because FSHOX has outperformed the S&P 500 index since August of 2014. Similarly, FRIFX has outperformed the benchmark Fidelity Spartan U.S. Bond Index Fund (FBIDX).

As the U.S. economy continues to improve, the Fed may start to increase interest rates in late 2015 or early 2016. In a rising interest rate environment bond investors may find it increasingly difficult to identify income funds that do not decline in value. As an example, the Fidelity High Income Fund (SPHIX) has already started to decline:

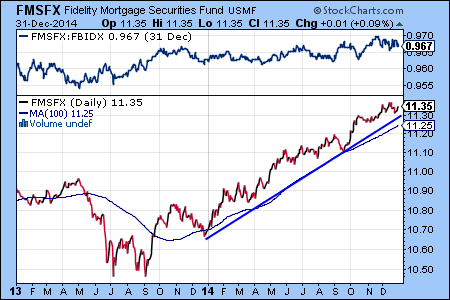

Two income funds that can outperform in 2015 are the Fidelity Spartan Municipal Income Fund (FHIGX) and the Fidelity Mortgage Securities Fund (FMSFX). The current yield of FHIGX is 3.54%, while FMSFX yields 2.49%.

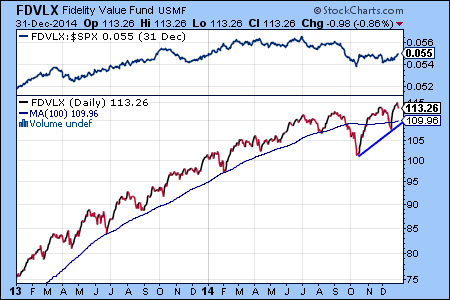

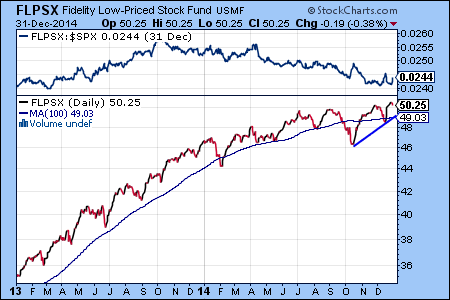

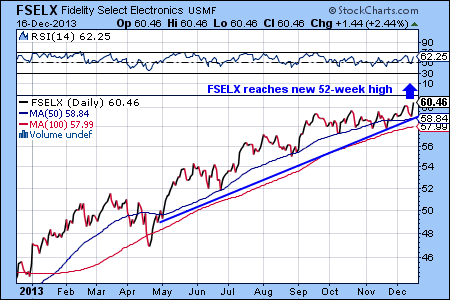

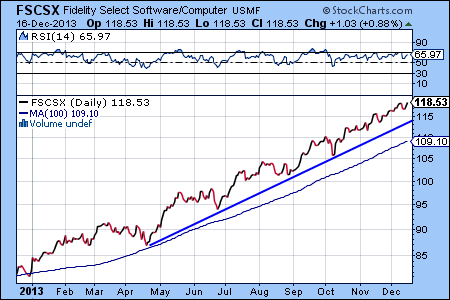

Style rotation refers to the periodic over and under performance of different investment styles, such as growth vs. value, or large cap vs. small cap. For most of 2014 growth has outperformed value investing, and large caps have outperformed small caps. In 2015, we think that these relative trends can easily reverse. Two Fidelity funds, which can help investors to participate, are the Fidelity Value Fund (FDVLX) and the Fidelity Low-Priced Stock Fund (FLPSX):

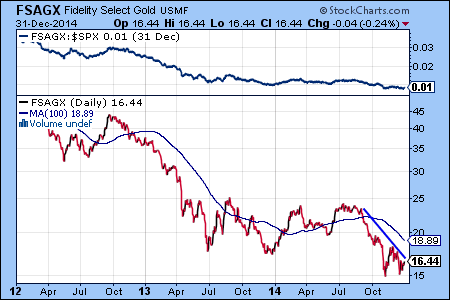

Investing in gold mining stocks can provide an attractive opportunity for portfolio diversification. Of course, the best time to invest in the gold mining sector is when it is not declining. Unfortunately, that is not the case right now. However, should this trend reverse, the Fidelity Select Gold Fund (FSAGX) is an excellent mutual fund for investing in this sector.

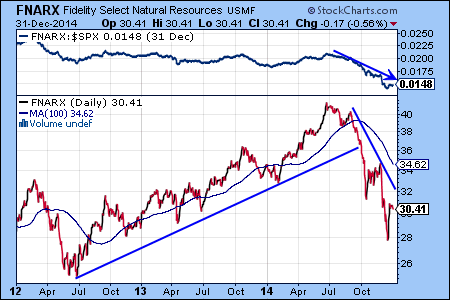

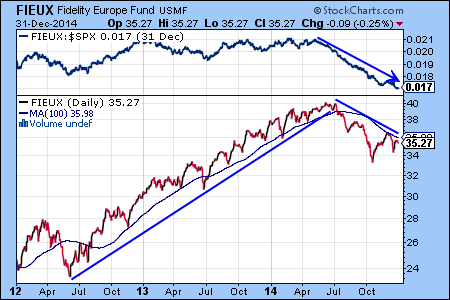

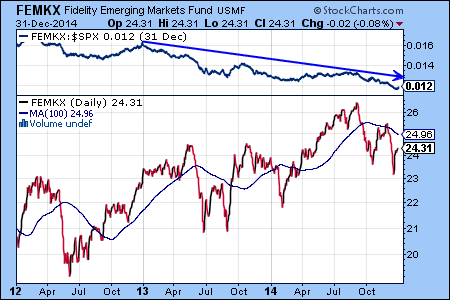

The history of the stock market shows that the weakest investments in one year can often become the best performing investments a year or two later. However, looking at natural resources and international stocks, the two weakest investments areas in 2014, we think that they likely to continue to decline in early 2015, therefore it is too early to accumulate an investment position.

Read more about investment strategies involving these funds at FidelitySignal.com

.