While the benchmark Fidelity Spartan U.S. Equity Index Fund (FUSEX), which is Fidelity’s S&P 500 index fund, barely moved higher today, multiple sector funds continue to show increased relative strength and may become promising equity investments for the next weeks or months. The first chart shows that FUSEX bounced off of the blue support line following the January market sell off and just barely holding above the 100-day moving average:

The next chart shows that Fidelity Real Estate Fund (FRESX) is one of the most interesting opportunities to watch for in the next few weeks. The top part of the chart displays the relative strength, which is the ratio of FRESX versus the S&P 500 index. The blue arrow indicates that the relative strength is improving for this sector starting from the beginning of January. Indeed, FRESX did not correct as much as FUSEX in the recent sell off and has already broken out to a new high for the year. The 1-year chart also shows that FRESX has not yet established a clear bullish trend, but the price action is promising.

The long-term picture for the technology and healthcare sectors is very different from real estate, as these large sectors have performed very well last year, but did not correct hard in January, and their relative performance compared to the broad market indexes continue to improve. Fidelity has multiple select funds for both of these sectors. We show here two examples of health care funds (FSPHX and FSMEX), which continue to provide excellent returns:

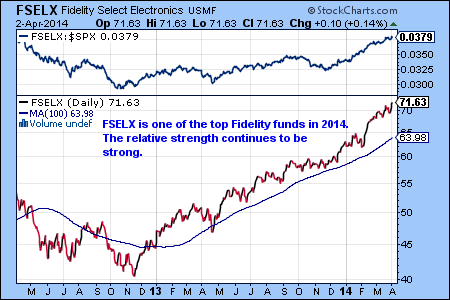

The following two charts show examples of two Fidelity technology funds (FSELX and FSPTX) with increasing relative strength and promising outlook:

One of the most interesting recent developments has been the strong rally of gold mining stocks. As the result, the Fidelity Select Gold Fund (FSAGX) has gained 11.74% already this year. The five year chart below shows that FSAGX reached its peak in 2011, but dropped in the following year and a half by almost 68% to reach the most recent low in last December. The blue downtrend line appears to be broken now, but since the gold mining sector can be highly volatile, investors should be very cautious with taking large positions in this sector until a clear uptrend gets established. For example, in the second half of 2012 gold made a similar bullish move, but resumed its bear market for another year:

Source: FidelitySignal.com

.