Summary:

- The German equity market is in a downtrend with negative impact for Europe

- The bear market in natural resources continues to pressure Latin American and Asian markets

- In our opinion, international markets will continue to decline and should be avoided in the near term

In our June blog post we warned about the rise of geopolitical risks and their impact on international markets. In the summer, one of the main concerns was the potential exit of Greece from the Euro Zone. While the exit did not happen, the continued weakness of the Greek equity market (GREK) shows that Greece is not yet in a better shape than before, and it is likely that the question will have to be addressed again in 2016.

Our current concern is the weakness of the German market, which is the largest and strongest economy of Europe. To illustrate the concern, lets take a look at two German bellwether stocks, Volkswagen (VLKAY) and Deutsche Bank (DB).

The chart below shows that the highly publicized “Dieselgate” emissions scandal has caused a more than 50% drop for the Volkswagen stock so far. With litigations just starting up and the recall for the diesel cars still not available, we see the weakness to continue for the near term. The chart of Deutsche Bank is also very bearish with a recent technical breakdown below the support level.

The chart of the German equity market shows a similar negative pattern:

Besides the weakness of the German market, Europe has two additional problems that will have to be resolved before we can turn bullish again. The first is the concern about the effectiveness of the quantitative easing program with the ECB starting to hint again at the need for a new round of money printing. The second concern is the economic impact of the flood of immigrants and the political tensions it created in the Euro Zone.

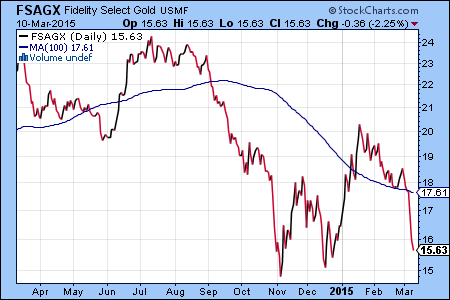

Our second topic is the impact of the bear market in natural resources, such as oil, on emerging markets that are net exporters of raw materials. The chart of the Fidelity Natural Resources Fund (FNARX) shows that the bear market resumed in late summer and downside volatility is very high:

It is not surprising to see that equity markets in Latin America and in Asia are also in a steep decline:

Visit FidelitySignal.com for investment strategies involving Fidelity mutual funds.