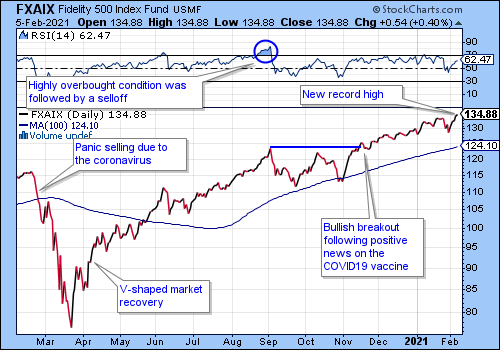

The S&P 500 index continued the bullish momentum in the first weeks of 2021 and made a new record high at the end of last week. We are cautiously bullish, as the combination of the rollout of COVID19 vaccinations, expectations for additional fiscal stimulus, and a rebounding economy can continue to fuel the gains. However, in our view, international tensions and the uncertainty around anticipated tax legislation can become headwinds for the equity market.

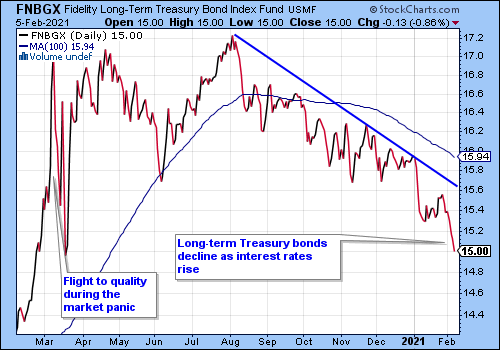

Steadily rising interest rates caused long-term Treasury bonds to enter a declining trend starting in August 2020. This declining trend continued in January 2021 (Chart 2).

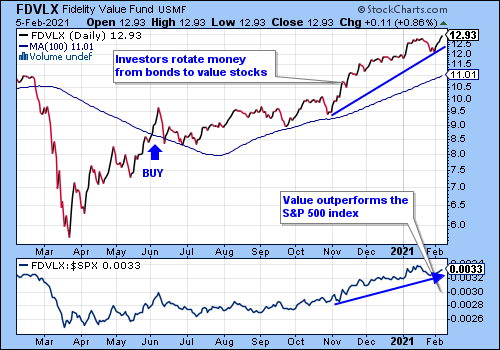

While large-cap technology and other growth investments received most of the attention in recent months, we’d like to note that value stocks have outperformed the large-cap S&P 500 index (Chart 3). We think that this is largely due to money coming out of declining bond investments. In essence, dividend-paying value stocks are taking the place of traditional income-oriented bond funds.

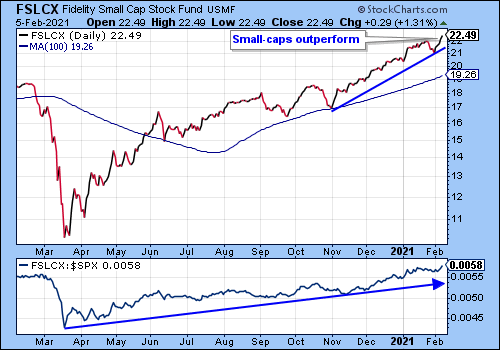

Small-caps are also outperforming large-caps since the lows of the COVID19-related market panic in March 2020 (Chart 4). Since smaller capitalization companies were impacted more severely in the pandemic, a rebounding post-covid economy makes small-cap stocks more attractive, as a group.

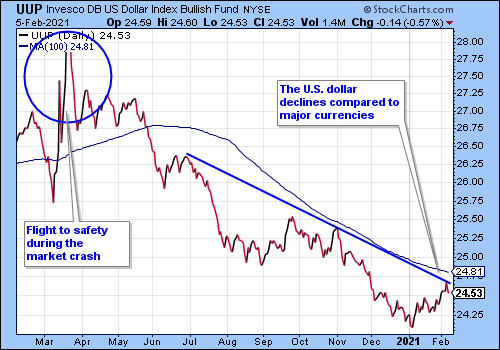

We see the declining trend for the U.S. dollar vs. the basket of major currencies continuing, but the weakness will probably depend on the extent and frequency of the fiscal stimulus and changes in monetary policy.

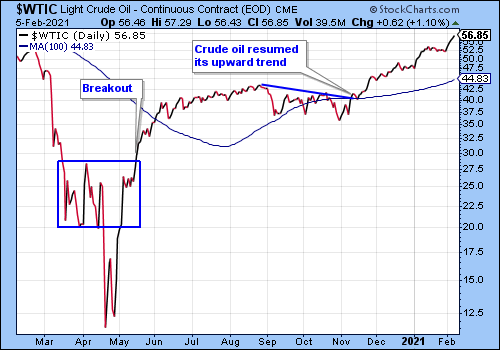

In part due to the weakening dollar and part due to the strengthening global economy, natural resources are in a rising trend. I’d like to highlight here the benchmark West Texas Intermediate Crude (WTIC) oil. WTIC hovered in a broad trading range between August and November of last year but started a steady climb after the first positive news about the COVID19 vaccines became available (Chart 5). We would not be surprised to see natural resources performing well in 2021.

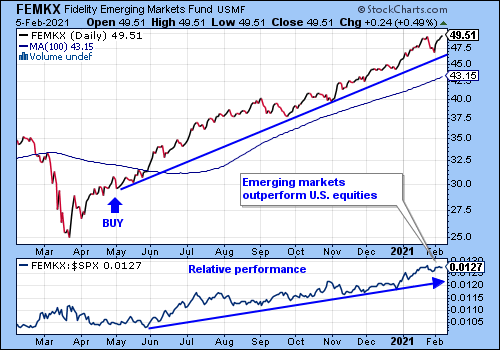

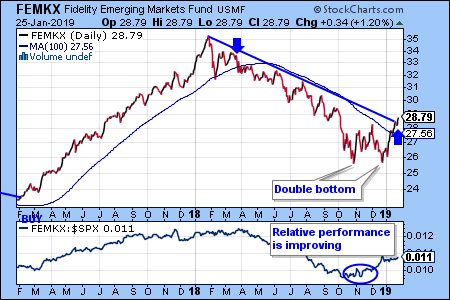

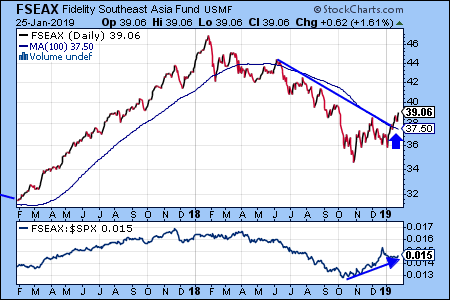

International markets are also providing exciting performance currently with emerging markets leading the way (Chart 7), as economies in Southeast Asia seem to recover faster from the pandemic than the U.S., and Latin American economies benefitting from the natural resources boom.

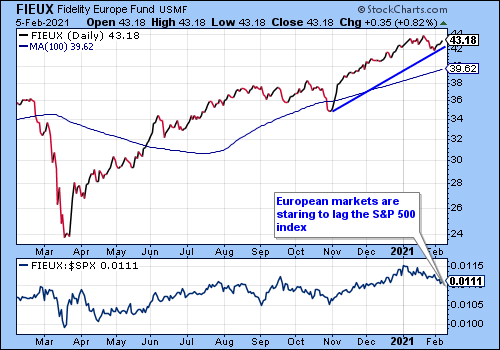

European markets are starting to lag the S&P 500 index (Chart 8), probably due to a slower pace of the vaccinations, and the short-term economic disruption caused by BREXIT. A notable exceptions are Southern European countries, such as Italy and Greece, which will benefit from increased tourism post-covid.

Click here to view the rankings of all Fidelity sector funds. The performance comparisons are updated daily utilizing the momentum screen at FidelitySectorReport.com.

.

.