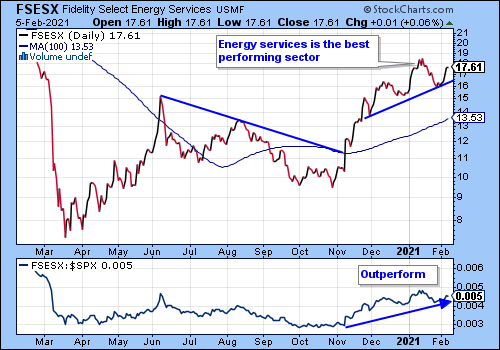

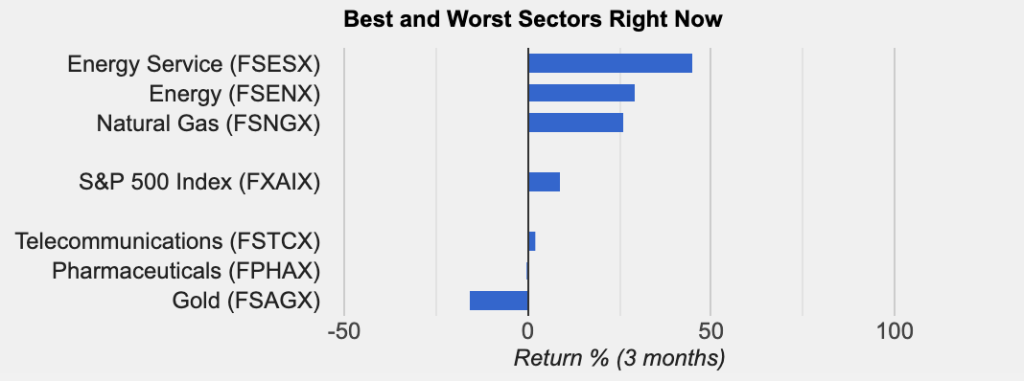

The comparison of the three-month returns of the 40 Fidelity Select sector funds shows a wide performance gap between the best and the worst sectors:

Investments in natural resources gained the most. The combination of the rollout of COVID19 vaccinations, expectations for additional fiscal stimulus, and a rebounding economy can continue to fuel the gains, in our view. In this group, the Fidelity Select Energy Services Fund (FSESX) is the top performer (Chart 1).

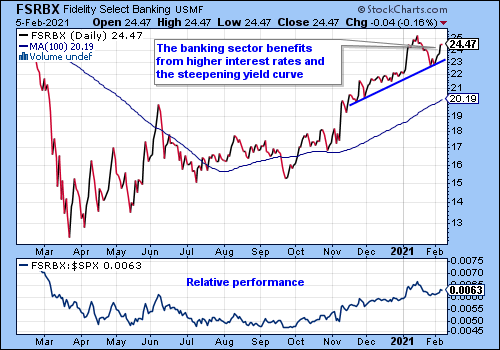

Higher interest rates and the steepening of the yield curve benefitted stocks in financial services. The Fidelity Select Banking Fund (FSRBX) shows the best gain in this group (Chart 2).

The rebound of economic activity, higher savings rates, and anticipated easing of the pandemic related restrictions can further increase consumer spending. Travel and other leisure investments are especially poised for a rebound. We think that the Fidelity Select Consumer Discretionary Fund (FSCPX) is positioned well for a strong performance in 2021 (chart 4).

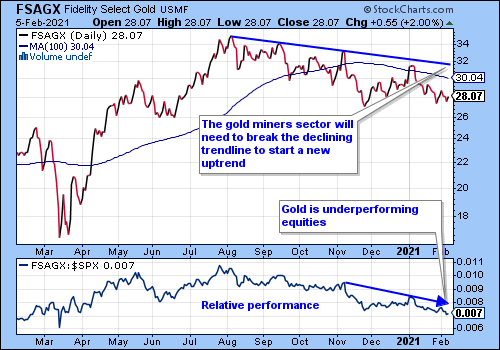

The weakest sector fund in our survey is the Fidelity Select Gold Fund (FSAGX), as the relative performance of gold stocks vs. the S&P 500 index (shown in the bottom panel of Chart 4) continues to trend lower.

Click here to view the rankings of all Fidelity sector funds. The performance comparisons are updated daily utilizing the momentum screen at FidelitySectorReport.com.

.

.