Summary

- The steep rise of the Treasury note and long-term Treasury bond yields caused a sharp selloff in most equity sectors

- Technology experienced the largest decline, but a short-term oversold rally is likely

- Natural resources and financials continue to gain, despite the market weakness

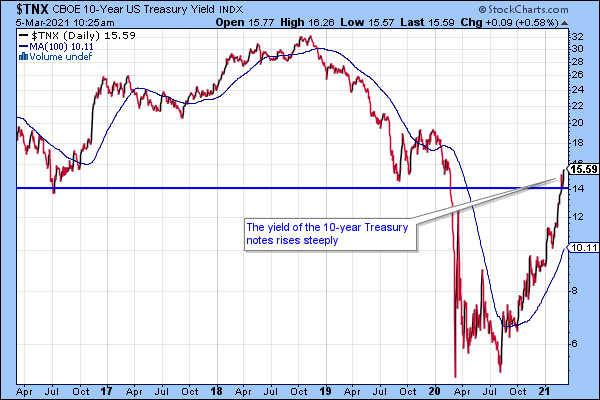

A combination of faster than expected economic recovery from the pandemic, new fiscal stimulus, and accommodative monetary policy raised inflation expectations that resulted in a rapid increase in yields (Chart 1).

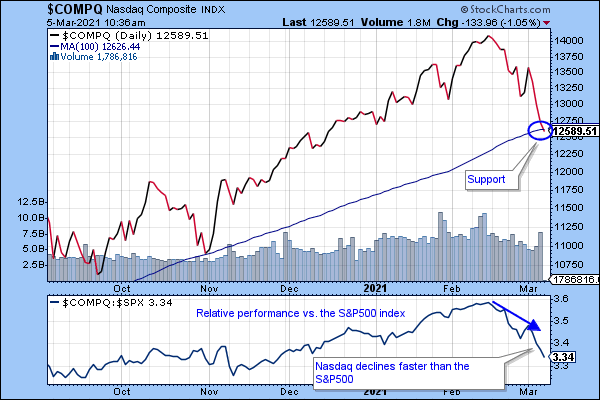

Higher bond yields also caused a sharp selloff in technology. Chart 2. shows that the technology-focused Nasdaq index is nearing its trend support that increases the likelihood of at least a short-term oversold rally. However, if yields continue to rebound towards the historical levels, the selloff can resume too.

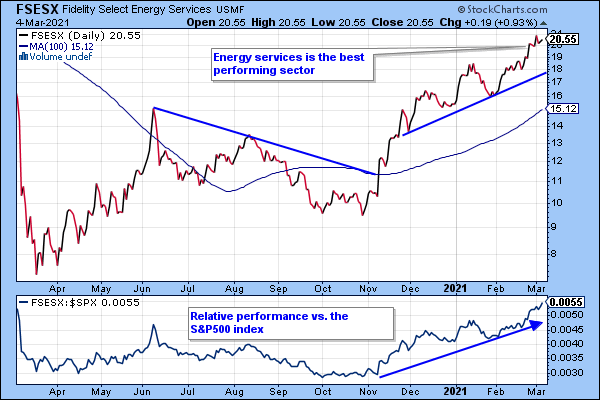

Natural resources, including energy, is the best performing industry group due to expectations of a quick worldwide economic recovery, limited supply increases, and the weakness in the U.S. dollar. Within this group, the Fidelity Select Energy Services (FSESX) is the best performing sector fund (Chart 3).

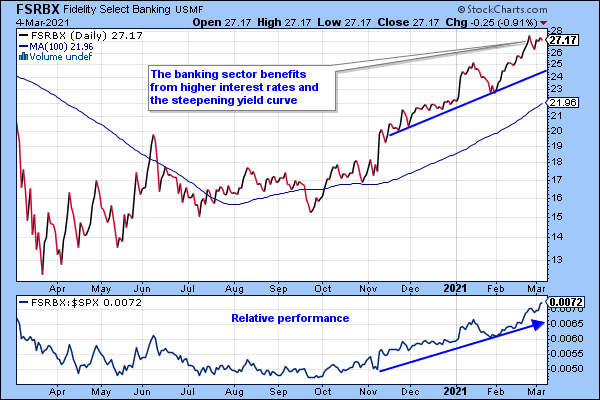

Financials have also gained in a weak market environment due to the steepening of the yield curve that benefits banks and other sectors in this group. I highlight here the Fidelity Select Banking Fund (FSRBX), as the top performer (Chart 4).

Click here to view the rankings of all Fidelity sector funds. The performance comparisons are updated daily utilizing the momentum screen at FidelitySectorReport.com.

.