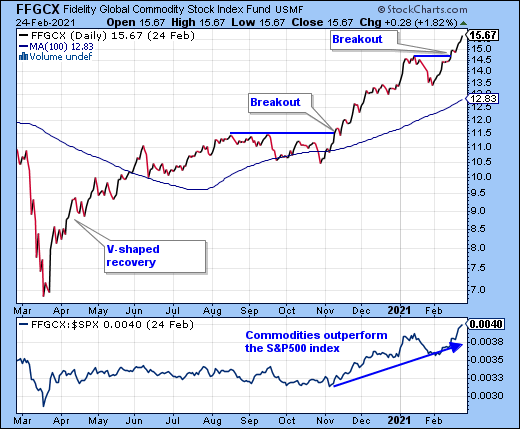

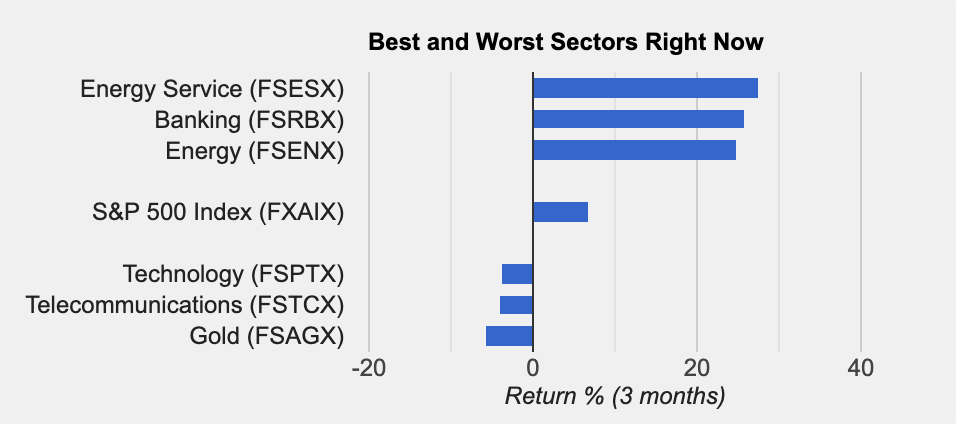

With long-term interest rates rising rapidly and the potential for higher inflation, it is not surprising to see investments in natural resources, such as energy, outperforming the broad market by a wide margin (Chart 1). The declining strength of the U.S. dollar vs. other currencies is also an important contributing factor, since many of the commodities are priced in dollar terms.

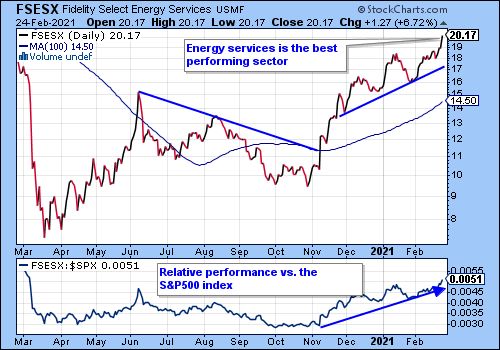

Out of the 40 Fidelity Select sector funds, Energy Services (FSESX) is the best performer (Chart 2).

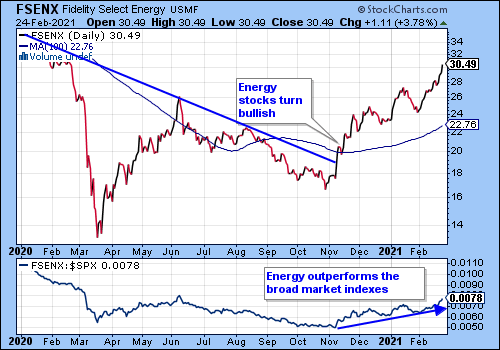

Large integrated oil companies are also benefiting from higher oil prices and renewed interest from investors (Chart 3).

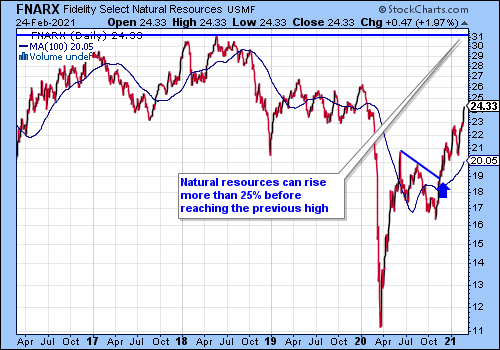

The 5-year chart of the Fidelity Select Natural Resources Fund (FNARX) shows that there is plenty of runway left before reaching the previous high in 2018 (Chart 4). This is in sharp contrast to most equity sector funds, which already surpassed their previous highs.

In a previous article, I highlighted the Fidelity Global Commodity Stock Index Fund (FFGCX) as another excellent mutual fund that allows investing in the natural resources boom. FFGCX continues to make higher highs and higher lows while outperforming the S&P500 index (Chart 5).

Click here to view the rankings of all Fidelity sector funds. The performance comparisons are updated daily utilizing the momentum screen at FidelitySectorReport.com.

.

.