The afternoon explosions at the Boston marathon precipitated a second wave of selling in the financial markets. The largest losses today were in sectors related to natural resources, such as gold and energy. The currently most out-of-favor international markets are Latin America and Eastern Europe. The top gainer was the Fidelity Spartan Long-term Treasury Bond Fund (FLBIX, change: 0.77%).

The greater than 10% drop in the gold sector is an unusually large sell-off that have not been seen in recent years. Gold is highly oversold now and ripe for a relief rally, but we continue to caution investors to stay away from this volatile sector.

Fidelity funds with the largest drops in today’s session:

| Fidelity Select Sector Funds | Change |

| Fidelity Select Gold (FSAGX) | -11.38% |

| Fidelity Select Natural Resources (FNARX) | -5.27% |

| Fidelity Select Energy Services (FSESX) | -5.07% |

| Fidelity International Funds | Change |

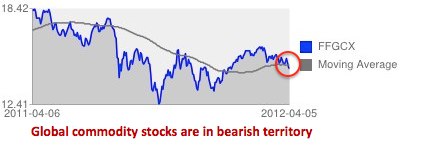

| Fidelity Global Commodity Stock (FFGCX) | -5.44% |

| Fidelity Latin America (FLATX) | -3.70% |

| Fidelity Emerging Europe, Middle East (FEMEX) | -3.27% |

Buy/sell signals for Fidelity funds are available at FidelitySignal.com